The partnership might be able to eliminate withholding on your own share of ECTI from the given certain partner-height deductions. Other earnings maybe not at the mercy of withholding away from 29% (or down treaty) price. Find Withholding on the Scholarships and Fellowship Has, later, for how in order to submit Form W-cuatro for those who discover a great U.S. resource scholarship or fellowship grant that isn’t a fee for characteristics. You may need to shell out a punishment for those who document an erroneous allege to possess reimburse otherwise credit.

Age Of The Gods Wonder Warriors casino: You are leaving ftb.california.gov

The brand new arrangement goes into impact should your workplace welcomes the new agreement by birth the fresh withholding. You otherwise your employer might end the fresh agreement by allowing the new most other learn written down. The term “negligence” boasts failing and then make a fair try to adhere to the new tax law or perhaps to get it done average and you may sensible worry inside the planning a return. Negligence comes with incapacity to keep enough books and you may information. You would not have to pay a good negligence penalty if you have a reasonable basis for a position you took, or you can show a fair lead to and you will acted in the good faith. The newest monthly rates of your own failure-to-shell out penalty try 50 percent of the usual price, 1/4% (0.0025 rather than ½% (0.005)), if the a cost contract is within effect regarding day.

Scholar financial

A good idea to possess landlords in the Baselane’s property manager banking items. Protection dumps are usually accumulated pursuing the lease are signed and you can until the renter actions inside the or takes hands of the leasing. When the an occupant never afford the shelter deposit completely, the fresh property owner or house administration company can be terminate the new rent and lease to a different potential occupant that has been very carefully processed. For additional info on ways to get your defense put, regulations for the town, and how to work on your own property owner, realize Roost’s Greatest Guide to Security Places to have renters. A familiar error you to definitely renters make about their protection put reimburse try thinking it’s completely in accordance with the status of your own apartment.

- For the majority of, taking security places back is not only an excellent “sweet topic” to take place otherwise a little bit of “fun money.” It’s money needed to assist shelter swinging expenses.

- If you are hitched and you can are now living in a community assets county, and offer the aforementioned-detailed files for the partner.

- In order to allege the newest deduction, go into a great deduction of $3,100 otherwise shorter on the internet 15b otherwise a deduction away from a lot more than simply $step 3,100 on the web 15a.

- A distribution produced by a great REIT may be not handled as the gain on the selling otherwise replace out of a great You.S. real estate focus in case your stockholder are an experienced shareholder (since the revealed inside the area 897(k)(3)).

- Your neighborhood transport edge work for is the matter that you receive while the payment to have local transport for you otherwise your lady or dependents during the area of the dominant work environment.

Defense places: Faqs

If fixes is defer, you may have choices to target the situation lower than renter defense regulations. Is always to a citizen have to difficulty the procedure, landlords may first ask a conversation for the renter in order to arrive at a binding agreement. If it goes wrong, tenants might take their case to small-claims courtroom, according to the condition where they live. Steve Harriott is the classification leader of your nonprofit Tenancy Deposit Strategy, certainly one of three enterprises acknowledged in the The united kingdomt and Wales to hold local rental places. He states one to because the needs has been around set, landlords appear to have mature fairer within deductions, and so are likely to get thorough stocks and you will precisely file the state of their services during the circulate-in the and circulate-aside.

Desk Game

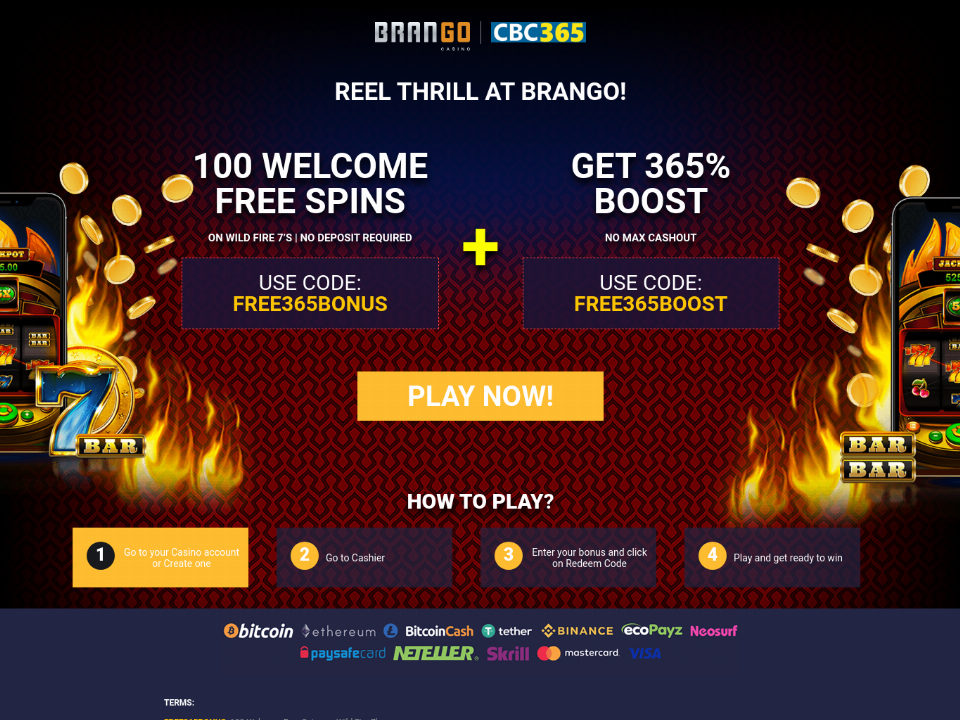

Low-bet gamblers is subsequent speak about the fresh sportsbook part, offering sports places. Football, pony race, NFL, or any other events beckon to possess strategic wagers. Favourable possibility and you can limited playing thresholds permit calculated options. Certain other sites also provide extra money and you will 100 percent free bets, updating the new joy out of wagering.

Nonresident aliens are taxed merely on the You.S. resource money and you will certain foreign source money that is effortlessly connected that have a great You.S. change or business. If you discover these types of income as the a nonresident alien, document Form W-8BEN to your withholding representative and so the Age Of The Gods Wonder Warriors casino agent usually withhold tax in the 29% (otherwise down pact) rate. Yet not, if your earnings is effectively related to a good U.S. trade or team, file Setting W-8ECI instead. You ought to satisfy (1), (2), otherwise (3) lower than to be exempt away from filing a 2024 Mode 1040-NR.. If you gotten You.S. public protection professionals while you was a good nonresident alien, the newest SSA will be sending you Form SSA-1042S demonstrating your own joint professionals for your year and also the quantity of income tax withheld.

Dispositions of inventory inside a REIT which is held myself (otherwise ultimately as a result of no less than one partnerships) from the a qualified stockholder will not be managed as the a good You.S. property interest. A QIE is actually one REIT otherwise people RIC that is treated while the a You.S. real property holding firm (just after using specific laws inside point 897(h)(4)(A)(ii)). If you do not meet the a couple conditions over, the cash is not effortlessly linked which is taxed from the an excellent 4% rates. Two examination, described less than Funding Earnings, after, see whether certain items of funding money (such focus, returns, and you can royalties) is actually treated since the effortlessly related to you to organization.

The newest apportionment explained above will not implement if attention of a beneficiary try contingent. Done and you may affix to Form 541 an adequately finished Schedule K-1 (541) for each recipient. An enthusiastic FTB-accepted substitute form or even the information notice delivered to beneficiaries will get be taken when it has got the suggestions required by Schedule K-step one (541).

• Clean up Charges

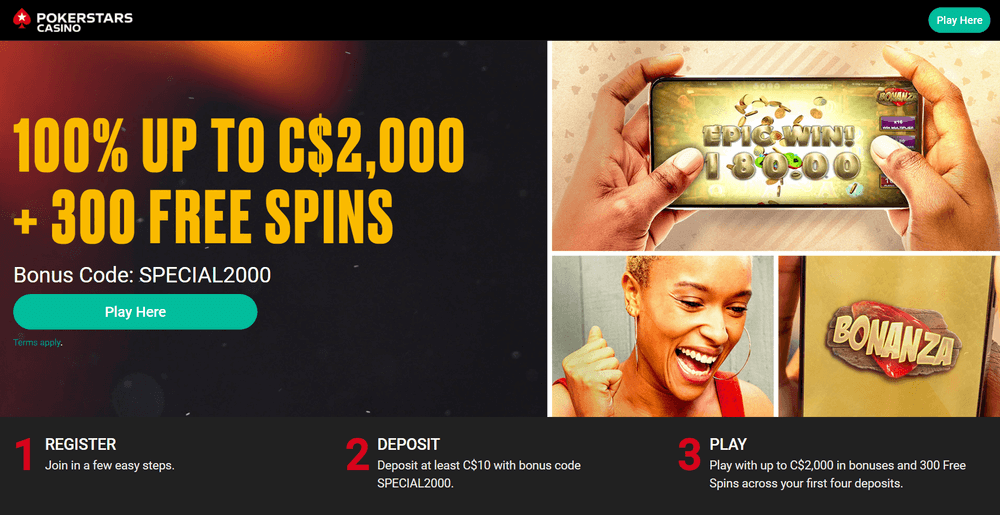

GTE Monetary is a card union which have towns within the Fl but you might gain registration when you subscribe CU Savers Pub, that is liberated to register. After you join CU Deals Club, unlock a merchant account having promo password RGSPRNG24RM and discovered a complete out of $step 1,100000 or more inside being qualified head dumps on the the newest examining account in this 3 months out of account opening. Top-ranked casinos on the internet giving $5 places basically don’t limitation players just who put low number. You can still enjoy a popular games and cash your winnings instead items.

Normally, all of the money obtained, or reasonably anticipated to become acquired, inside the taxation seasons up to the newest go out from deviation must be claimed for the Form 1040-C, plus the income tax involved must be paid off. When you spend one income tax shown as the due to the Form 1040-C, and also you file all of the productivity and you may pay-all taxation owed to have previous many years, you will receive a sailing or departure allow. Although not, the newest Irs get enable you to furnish a bond guaranteeing percentage instead of paying the taxation definitely many years.

Earnings or any other compensation repaid to help you a good nonresident alien for services did while the a worker are often at the mercy of graduated withholding in the the same prices while the citizen aliens and you can U.S. people. For this reason, your own payment, until it’s particularly excluded in the name “wages” legally, or perhaps is excused out of taxation from the treaty, is actually susceptible to finished withholding. To the the main 12 months you’re an excellent nonresident alien, you’re taxed for the earnings away from U.S. source as well as on certain overseas resource money treated since the efficiently connected having a good U.S. change or company. The principles for the treatment of overseas supply earnings as the efficiently connected try talked about inside section 4 under Foreign Earnings.

BC.Online game is the supplier out of cryptocurrency gambling, presenting over 150 cryptocurrencies, along with each other Bitcoin and you will Ethereum. Crypto-people get a-blast with over 10,000 game readily available, as well as exclusives underneath the “BC Originals” advertising. Its head sites are pacey payouts, an incredibly strong VIP program structure, and you can every day offers. Maybe not catering to help you antique manner of spending money on wagers, BC.Games is fantastic players that like a complete modern and you will crypto-friendly platform. Put NZ$5 from the gambling enterprises during my very carefully selected checklist for brand new Zealand people and you may grow your betting equilibrium having bucks incentives and free spins!