Blogs

One of several simpler provides you to casinochan reviews Pursue also offers try mobile put, making it possible for consumers to help you put monitors to their membership with their cellphones. Although not, there are restrictions positioned to possess mobile dumps, and it also’s essential for users to know this type of constraints to avoid one issues. In this post, we will discuss the new Pursue restrict for cellular deposit, in addition to certain fascinating items and you will popular questions about this particular feature. Merrill Lynch, a subsidiary away from Lender out of The united states, is a respected money management firm which provides a variety of monetary characteristics to help you their customers.

Mission Federal Credit Connection Automatic teller machine Detachment Limitation

- To help you determine just how much you have got remaining on your everyday otherwise monthly limit, simply deduct how much money you may have currently placed due to mobile look at deposit regarding the full limitation.

- Incorporate the handiness of mobile banking with USAA and then make their monetary purchases much easier and you may problems-totally free.

- No, Merrill Lynch merely welcomes monitors removed for the U.S. loan providers to own cellular deposits.

- In this article, we’re going to mention the internet take a look at put limit during the Financial from America, along with provide particular fascinating details about this particular feature.

If you are seem to achieving the $10,000 limit to possess paper currency deposits to the Dollars Software, you’re capable demand a rise for the limit. To accomplish this, get in touch with Cash Application service and provide factual statements about your bank account use and you can transaction records. Bucks Software often opinion your demand and discover if the a growth on the papers money deposit limitation is actually justified.

– If you wish to deposit more income versus daily limit lets, it is best to go to a Pursue part and you may talk to an excellent teller in the and make a much bigger put. No, dollars dumps at the an enthusiastic OnPoint Automatic teller machine have to be converted to the new membership proprietor’s membership. Zero, dollars places from the a keen OnPoint Automatic teller machine should be converted to your very own membership. Zero, 5th Third Financial merely accepts inspections that will be authored for the simple-sized paper to have cellular view deposit. No, Fifth 3rd Bank cannot take on currency sales for mobile take a look at deposit. No, Fifth 3rd Bank doesn’t take on post-dated inspections to have cellular consider deposit.

Ideas on how to Improve My personal Credit limit Having Money One

– There aren’t any restrictions for the amount of mobile dumps your produces within a month. – You can get in touch with customer service because of the mobile phone, current email address, or live speak to own help with the new mobile put ability. – Funds from a mobile deposit are usually readily available within this step one-step three working days. – There is certainly generally not a threshold to the number of mobile places you could make within a month, however, there is limitations to your complete number you could put.

Such, Woodforest National Lender will most likely not ensure it is certain types of monitors, for example third-team inspections otherwise checks which can be blog post-dated, to be placed via cellular put. The bank spends this informative article to search for the suitable daily restriction per consumer. Let’s say you have got step three monitors in order to put during the a great TD Bank Automatic teller machine, with quantities of $step 1,five-hundred, $2,one hundred thousand, and you may $2,500. The quantity of the fresh checks try $6,000, and this exceeds the fresh daily restriction from $5,000. In this instance, you would need to put precisely the monitors that don’t meet or exceed the individual consider restrict from $dos,500. Hence, you can put the new $1,five-hundred and you can $dos,000 inspections, totaling $3,five hundred, since the $2,five hundred look at will have to be deposited to the a new time.

Whatʼs The greatest Find Credit limit

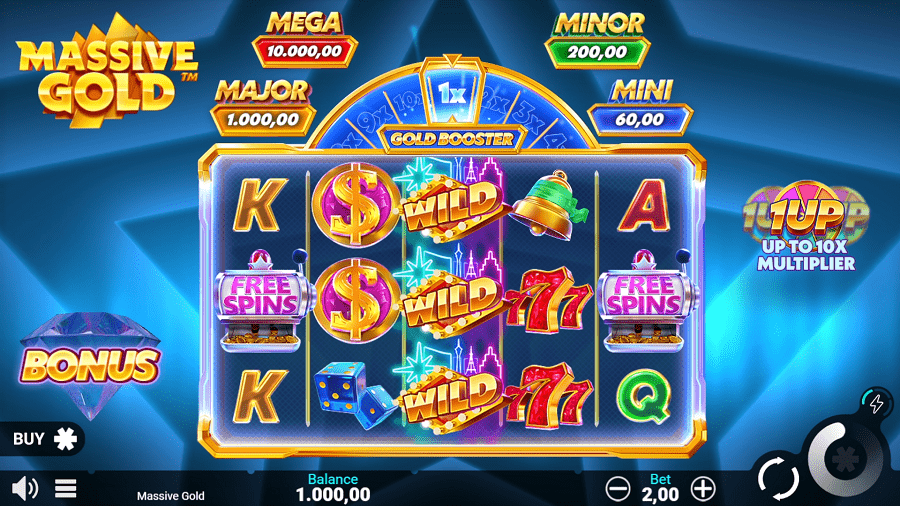

Because the 2015, you will find reduced the extra weight out of outgoing packaging for each and every delivery from the 41% typically, that’s more 2 million a lot of packaging issue. – 5th 3rd ATMs are designed to take on most You.S. currency denominations, therefore you should perhaps not come across any complications with deposit bills. Having multiple prizes lower than their belt, Casumo was an industry talked about out of undertaking a passionate creative and you can a good playing feel.

Merrill Lynch recommends playing with monitors that will be inside great condition, with obvious and you may legible composing, to ensure a profitable mobile put. Car insurance are a requirement for everybody motorists inside Arkansas, however, looking an easily affordable option is going to be a problem. This type of insurance policies lets motorists to pay for the thirty day period to help you week basis without the need to make a huge initial payment.

Although this restrict may be awkward for most users, they suits an essential goal within the keeping the protection and you can credibility of cash Application as the a mobile commission provider. When you yourself have any questions or issues about Bucks Application’s report currency put limit, make sure you get in touch with customer support to own advice. Cash Software, a greatest cellular payment service, has been a spin-in order to platform to have transferring currency between family and friends, and make purchases, and even investing holds.

Goal Lane Mastercard Large Restriction

Too much reserves had been shorter by the matter necessary from the dumps developed by the fresh finance made in Phase 1. For many who kept your money for the reason that make up another year, you are able to earn $424.74 in the need for year a few, for all in all, $832.32 within the focus more 2 yrs. You get a lot more on the 2nd year since the interest percentage is calculated to the initial deposit and also the interest your earned from the first year. To find the desire that will develop on your own family savings, bring such steps. Material interest is the focus you earn on your own brand-new currency and on the attention you to have racking up. All of our couples do not pay us to make sure positive analysis of its goods and services.

– Bank of The usa cannot take on blog post-old inspections to possess cellular deposit, so you will have to wait until the newest date to your look at prior to transferring it. Yet not, particular issues, such insurance policies inspections otherwise government-awarded monitors, may have additional criteria. Yet not, it is very important observe that the bank could possibly get techniques the brand new consider before the go out specified, depending on their rules.

Yes, team users may deposit monitors on the internet having a higher month-to-month limitation away from $fifty,100. Pursue Lender doesn’t have a certain limitation to the count away from mobile dumps you possibly can make per day otherwise month. If you stand inside the daily and you will month-to-month limitations to possess deposit number, you may make as much deposits as needed.

Alternatively, you might get in touch with Citi customer support to inquire of solution deposit alternatives. – There are no restrictions to the measurements of the newest checks you to is going to be deposited, providing you stay within the $one hundred,one hundred thousand daily restrict. If you have not enough finance on your own membership, the fresh consider put may be denied. It is important to make sure to have enough financing to defense the newest consider amount just before transferring it. Cellular deposits try canned easily, always in one working day. Thus you have access to the money earlier than in the event the you used to be so you can deposit the newest consider at the an actual physical lender location.